Building Information Modeling (BIM) has transformed construction practices across North America, Europe, and parts of East Asia. Yet despite its proven benefits in reducing costs, minimizing errors, and streamlining collaboration, BIM adoption remains surprisingly limited across India and Southeast Asian countries like Thailand, Vietnam, and Malaysia.

As someone who's worked with architecture and construction firms across these regions, I've observed firsthand how the realities on the ground create legitimate barriers to BIM adoption—barriers that can't simply be dismissed as "resistance to change."

"That Costs How Much?!"

The financial barrier to entry for BIM is substantial in these growing economies. Autodesk Revit, the industry-standard BIM software, costs approximately $2,545 annually per license—a figure that might seem reasonable to large Western firms but lands differently in markets where architectural fees are often a fraction of their Western counterparts.

For context, a small architectural practice in India typically generates between $15,000-$50,000 in annual revenue for very small firms (1-3 people), and $50,000-$100,000 for small to mid-sized practices (5-10 people). Investing in just three Revit licenses could consume 5-10% of a firm's entire revenue—before factoring in the necessary hardware upgrades, training costs, and productivity dips during implementation.

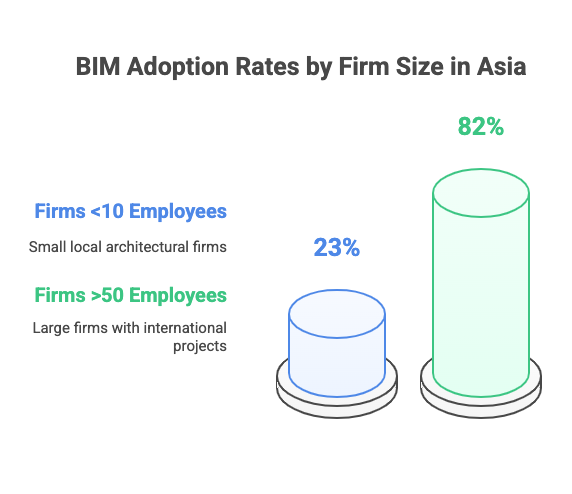

The numbers tell the story: according to a 2023 survey by the Council of Architecture in India, only 23% of architectural firms with fewer than 10 employees had implemented BIM, compared to 82% of firms with over 50 employees. The pattern repeats across Thailand, Vietnam, and Malaysia, where BIM adoption remains concentrated among larger firms with international projects or foreign investment.

"But None of Our Clients Are Asking For It..."

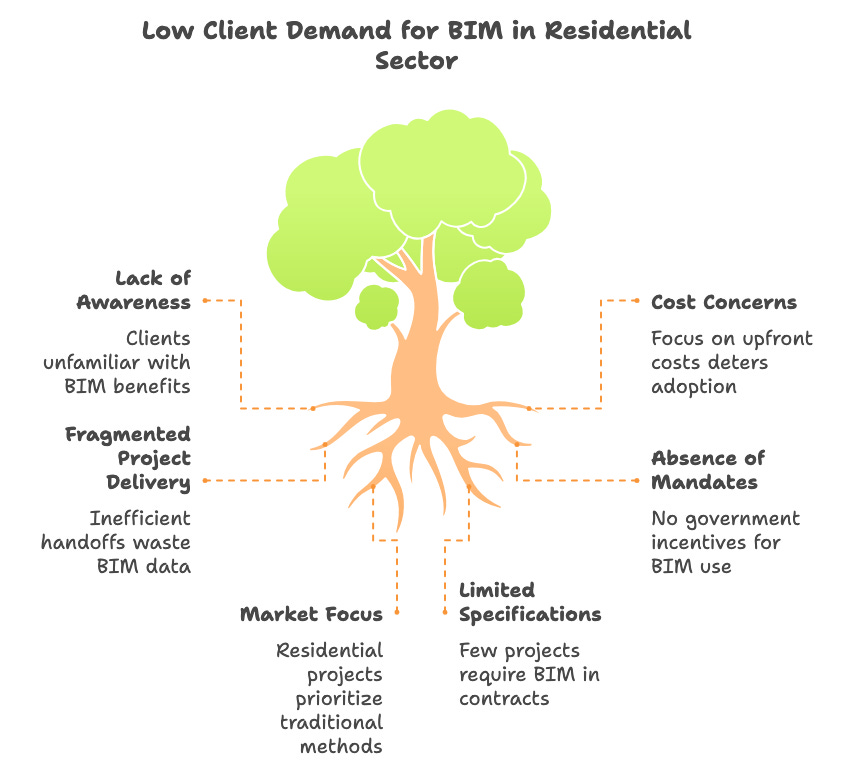

Perhaps the most significant barrier is the simplest: client demand for BIM deliverables remains low in these regions, particularly in the residential sector that dominates construction volume.

In India, residential construction accounts for approximately 75% of the building market, with most projects commissioned by individual homeowners or small-scale developers who are unfamiliar with BIM and primarily concerned with upfront costs. A 2022 market survey across Southeast Asia found that only 7% of residential projects specified any BIM requirements, compared to 67% of large commercial projects.

The project delivery model in these regions further complicates matters. While Western markets increasingly use integrated project delivery methods that maximize BIM's collaborative benefits, projects in growing economies typically follow a fragmented approach where designs change hands multiple times.

"We spent months developing a detailed BIM model for a commercial complex," explains a colleague who runs a mid-sized architecture firm in Gujarat, "only to have the client take our concept drawings to another firm for development, then pass it to a third team for construction documentation. All that embedded data was essentially wasted."

Without government mandates like those in Singapore or the UK that drove adoption in those markets, the incentive structure simply doesn't support widespread BIM implementation.

Finding BIM Experts Is Hard in this part of the world

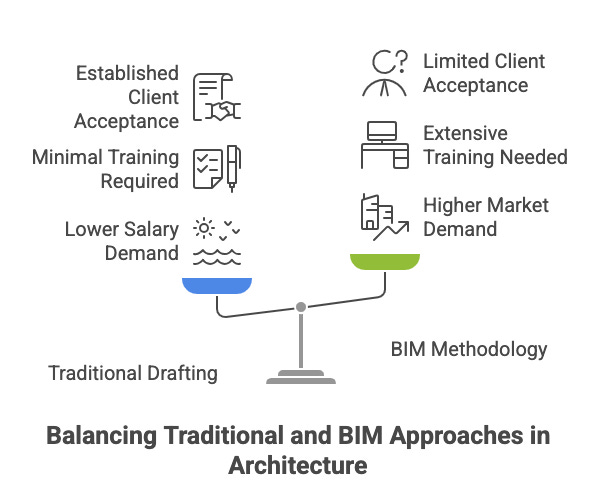

The technical learning curve presents another significant hurdle. Professional Revit training requires substantial time investment—typically 40-60 hours of formal instruction followed by 6-12 months of practical application to develop true working proficiency. This represents a significant commitment when project opportunities to apply these skills remain limited in the regional market.

In markets where architectural education still heavily emphasizes traditional drafting and design methods, this expertise gap is particularly pronounced. A 2023 education survey found that only 35% of architecture schools in India and 42% in Southeast Asia had incorporated comprehensive BIM training into their core curriculum.

The resulting scarcity of skilled BIM professionals creates a challenging dynamic: firms hesitate to invest in BIM without access to qualified staff, while professionals are reluctant to invest time in developing BIM skills without clear job opportunities to apply them.

"We tried hiring BIM specialists from the limited pool available," says a director at a design firm in Kuala Lumpur. "But they commanded salaries 40% higher than our traditional drafters, yet our clients weren't willing to pay more for BIM-based deliverables. The math simply didn't work for us."

When Manual Work Gets the Job Done Faster

In labor-abundant economies, the economic equation often favors adding more staff over investing in technology. Across India and Southeast Asian countries, architectural drafting labor costs remain significantly lower than in Western markets—typically ranging from $1-6 per hour depending on the country and experience level (with Singapore being a notable exception). At these rates, it's often more economical to address design complexities by adding drafters than investing in software.

At these rates, it's often more economical to address design complexities by adding drafters than investing in software. A team of four drafters working with familiar CAD tools can produce construction documents faster than a single BIM specialist still climbing the learning curve—especially when projects prioritize speed over long-term data integration.

The tight profit margins in these competitive markets—typically 8-15% compared to 15-25% in developed markets—leave little financial cushion for experimentation. When architects are competing primarily on price, investing in BIM capabilities often feels like a luxury rather than a necessity.

Making BIM Work on Their Terms

Despite these challenges, innovative adaptations are emerging across the region as firms seek the benefits of BIM without the full implementation cost.

More affordable alternatives to full-featured BIM platforms are gaining traction, from established tools like ArchiCAD and Vectorworks to regional solutions that offer simplified BIM capabilities at approximately 40% lower cost than mainstream options.

Many firms are adopting hybrid approaches that strategically implement BIM elements where they deliver the most value—using simplified BIM tools for initial massing and spatial planning while maintaining traditional CAD workflows for detailed documentation, achieving significant benefits with minimal disruption to established processes.

The Path Forward

Despite challenges, BIM adoption is gradually increasing through government initiatives like India's inclusion of BIM in its National Building Code and Vietnam's pilot mandates for public projects.

As labor costs gradually rise and client expectations evolve, we'll likely see increasing BIM adoption—but on terms that make sense for the regional context. The question isn't whether BIM will find its place in these growing economies, but how it will be transformed to suit local conditions.

What might a distinctly Asian approach to building information management look like when freed from Western assumptions about project delivery and resource allocation? The next generation of tools may well emerge from these markets themselves, built from the ground up to address our specific challenges.

Architecture design production remains low-leverage knowledge work. We can call it a vestige of the apprentice/draftsperson past, an incentive misalignment with the prevalent business model, or the overall diminishing value captured by design in the value chain. One thing is for certain, it’s a headwind to process and technological innovation. More US/EU firms are opting to take the easier route to move work to lower cost markets than the harder path to increase leverage in the work itself.